It seems that the Germans are in a mood slump that makes it impossible to perceive signs of hope. Like a mentally ill patient suffering from depression, we simply ignore good news. However, they are now unmistakable. Crisis and recession are there, but they are coming to an end. There are six solid indicators for this.

Investmentfrühstück Recap

Investmentfrühstück Recap

As we conclude this year's Investmentfrühstück in Erfurt and Dresden, we extend our sincere gratitude to all participants for actively contributing to the dynamic and enriching atmosphere. We are thankful for the opportunity to present our funds and share industry insights with other experts. Overall, Mario Walter's meticulous event organization deserves commendation for the seamless execution.

Special thanks to our distinguished speakers—Patrick Grewe, Yasmin Mirzay from van Grunsteyn, and Herbert Dietz from PUNICA Invest GmbH —for their insightful presentations that greatly contributed to the discussions.

Stay connected for updates on our upcoming events!

Recording of the webinar "Commodity Update" from 14.12.2022

Note: This text is a translation from the original language, German.

If you could not make it to the "Commodity Update" webinar on December 14, 2022, or if you would like to revisit the content:

You can access the webinar recording by following this link: https://transcripts.gotomeeting.com/#/s/ccb7a2be07fedfdbf531c6f2462bb869fc73e9e24312fa44571d4aca3a16695.

Furthermore, we have included the webinar presentation as an attachment for your convenience.

Recording of the webinar "Commodity Update" from 14.12.2022

Note: This text is a translation from the original language, German.

If you could not make it to the "Commodity Update" webinar on December 14, 2022, or if you would like to revisit the content:

You can access the webinar recording by following this link: https://transcripts.gotomeeting.com/#/s/ccb7a2be07fedfdbf531c6f2462bb869fc73e9e24312fa44571d4aca3a16695.

Furthermore, we have included the webinar presentation as an attachment for your convenience.

Economic Weekly: "The Wonderful World of Commodity Stocks"

Note: This text is a translation from the original language, German.

The stock of Trench Metals Corporation must be a real insider tip. On the one hand, there are the business prospects for the Canadian company, which claims it will exploit uranium deposits – the plans are laid out in epic detail on the website Aktien check.de. They talk about epochal takeovers, historical resources, and the Uranium discovery of the year. On the other hand, there's the stock price: at the end of October, it was a meager 41 cents. A bargain. Or is it? Someone will probably make money from Trench Metals' stock sooner or later. The question is: who will profit? A clue is provided in a note at the end of the promotional prose. It says that the sponsor of the publication or its employees are shareholders of Trench Metals. Furthermore, we should consider that the sponsors of the study may intend to divest their own stock holdings in Trench Metals Corp. in the near future and, thus, profit from rising stock prices.

You can read the full article from Wirtschaftswoche in the attachment (available only in German).

MARKET AND MEDIUM-SIZED BUSINESSES - We can do it! 6 Reasons Why It's Better Than It Looks

Note: This text is a translation from the original language, German.

It seems that the Germans are in a mood slump that makes it impossible to perceive signs of hope. Like a mentally ill patient suffering from depression, we simply ignore good news. However, they are now unmistakable. Crisis and recession are there, but they are coming to an end. There are six solid indicators for this.

First: Gas prices are dropping again. The main reason is full gas storage in Europe. Filling levels above 90 percent are the rule, Belgium has reached 100 percent, and no more gas is going in. With falling energy prices, inflation is decreasing – secondly. The central banks' measures are contributing to the reversal. Third: Stock markets have recently shifted from gloomy to friendly. Expectations are being traded on them, and they seem to be in the green zone. As a mood lifter, fourthly, is that, based on everything we know, the further course of the coronavirus situation will have rather manageable consequences. In Europe, doctors and governments have shifted to dealing with the infection like the annual flu waves in winter. Karl Lauterbach is probably the last one who still expects lockdowns. It is also clear that – fifthly – supply chains are relaxing. The problem still exists, but medium-sized businesses can handle it better: one has found new suppliers, and another has stocked up more. And finally, sixthly: the job market remains stable. The Federal Employment Agency is very cautious, but it does not expect a crisis because there is no wave of insolvencies in sight.

As a result of all these developments, the Munich-based Ifo Institute published a survey this week, which seems to have been somewhat overshadowed because it clearly does not fit the general mood of depression: Only 7.5 percent of companies in Germany see their existence threatened, which is significantly less than during the height of the Corona pandemic. "In view of the strong economic cooling, companies are showing great resilience," says the head of the survey. Now we just have to believe him.

Smart Investor Guest Article: A Dream for Contrarians

The current situation, in our view, represents a unique buying opportunity for precious metals and commodity stocks. Why? Because the overall long-term outlook and positive prospects for commodities and resource mining have not changed. However, gold and, in particular, stocks can be purchased at significantly lower prices than we could have imagined.

Note: This text is a translation from the original language, German.

Proven Inflation Hedge

Gold has proven to be an inflation hedge for thousands of years, and even though the performance of the precious metal has been disappointing this year, this can quickly change. The lackluster performance is partly due to the very strong US dollar and the extremely hawkish policy of the Federal Reserve. The Fed is responsible for a scenario in which market participants believe it will do everything in its power to combat inflation. Often, comparisons are made to the era of former Fed Chairman Paul Volcker when interest rates rose from 11% to over 20%. We consider this very unlikely because interest rates have already been raised significantly more in percentage terms than during Volcker's time, and states, businesses, and households are now much more heavily indebted.

Illusion of Control

The economic situation, considering a global recession and the debt situation, will leave central banks with no choice but to refrain from further raising interest rates or even to slightly lower them in the medium term. The moment when investors realize that precious metals are indeed a good hedge against inflation and that central banks can no longer maintain the illusion of control over inflation should present a unique opportunity for precious metals. When examining the development of gold this year in various currencies, differences become apparent. While the price of gold has fallen by 7% in US dollars, it has risen by 6% in both the Euro and, for example, the Australian Dollar. While the gold price and, in turn, revenues for producers have increased, the share prices of gold mining companies, for example in Australia, have declined by over 28% this year - a significant discrepancy that cannot be explained solely by increased production costs. On average, these costs have risen by around 10%. However, the largest cost component in the industry is labor expenses. The initial costs for new mines planning to start production in the coming years have also increased significantly. This is likely to delay some production launches and continue to negatively impact the supply.

Depressed mood

A positive point for contrarian investors is the current sentiment in the gold mining sector. In September, the two most important conferences within the sector took place. While a gold price of $1,700 per ounce would have caused true euphoria a few years ago, this time there were many dissatisfied voices. Despite excellent quarterly results, many mining company executives were rather downcast. The primary reasons for this were the share price losses, which were not at all rewarded by the market and investors, despite the outstanding performance.

Article from Smart Investor 11-2022, Guest Contribution by Tobias Tretter.

Christian Mallek recommends the Structured Solutions Next Generation Resources Fund

DAS INVESTMENT regularly asks independent asset managers for their fund recommendations. Here, Christian Mallek from the Sigavest asset management firm explains his recommendation for an equity fund.

Note: This text is a translation from the original language, German.

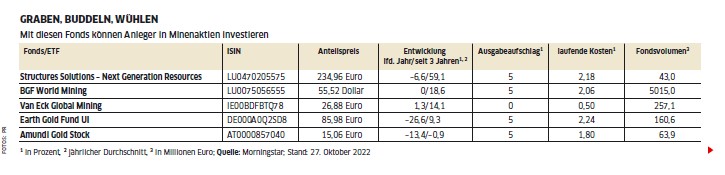

The trend towards renewable energy is unbroken. The fact that internal combustion engines are on the way out and the sale of electric cars has reached a record this year speaks a clear language. The name of the fund we are introducing is also clear. We hold it as part of the ESG component in our Sigavest Asset Management Fund. Structured Solutions Next Generation Resources (ISIN: LU0470205575)

invests in companies from the Rawmaterial sektor, which extract so-called next-generation raw materials. These are primarily raw materials needed for future technologies, medical progress, and demographic changes.

Fund manager Tobias Tretter from Commodity Capital places a strong focus on lithium companies, which make up around 58 percent of the fund's weighting. Another 15 percent is allocated to energy metals, followed by silver, base metals, and gold. An investment in the Structured Solutions Next Generation Resources Fund has historically been associated with high volatility. Investors had to endure a maximum drawdown of 75 percent at one point. However, they were rewarded with a ten-year return of 246 percent, equivalent to an average annual performance of over 13 percent. Long-term prospects for this investment sector appear promising. To mitigate fluctuations, a staggered entry is recommended, such as through savings plans.

Read here the complete article in "Das Investment" (available only in German)

Recording of the "Commodity Update" webinar from August 15, 2022

Note: This text is a translation from the original language, German.

During the "Commodity Update" webinar on August 15, 2022, Tobias Tretter provided an overview of the current situation in the commodity market.

You can listen to the entire webinar again by following the link below:

The presentation is included in the attachment.

Citywire Interview Tobias Tretter: AA-rated resource manager: "I see triple potential in gold mines."

Precious metals expert Tobias Tretter explains his outlook for the gold price and related mining companies in the interview.

Note: This text is a translation from the original language, German.

Tobias Tretter is the founder and CEO of Commodity Capital. According to our database, in the Citywire Natural Resources sector, Tretter, who holds an AA rating, has been the best-performing fund manager over the last five years. Tretter manages the fund that focuses on mining companies. Commodity Capital Global Mining Fund.

In the past five years, according to our database, you have been the undisputed number one in the field of resource fund managers. This naturally raises the question: What sets you apart from the competition?

It's the proximity to the projects and mining companies. When you look at the large flagship funds, their working methods are substantially different. Most of my colleagues primarily work from their desks. In contrast, we are mainly on-site, assessing not only the geology and economic viability of individual mines but also working conditions and interactions with the local population.

This results in a much more interesting portfolio, mainly composed of small and medium-sized companies. This somewhat different approach may not necessarily yield short-term benefits. However, over the course of several months or even years, a significantly higher performance becomes apparent.

Read the complete article here

Smart Investor: "Gold Before a Massive Rise"

Guest contribution by Tobias Tretter in Smart Investor

Note: This text is a translation from the original language, German.

The Fed raises interest rates by 0.75% and tries to combat the significantly increased inflation with the largest interest rate hike since 1994. The irony of this panic move is that just last year, the Fed was talking about a temporary higher inflation, and ECB President Lagarde still believes that inflation will return to 2%. Inflation will not resolve itself; it did not arise due to the war in Ukraine, supply chain problems, or increased commodity prices, but rather due to the excessive money printing by central banks and their zero-interest rate policies over the past 20 years.

Back to the 1970s?

In recent decades, we have been living far beyond our means and financing our needs with free money, which will eventually have to be repaid through a currency reform or higher inflation. The current situation strongly resembles the late 1970s, and there is already discussion about whether Powell can be the new Paul Volcker, who raised interest rates from 5% to nearly 20% in the late 1970s to curb inflation. Ultimately, real interest rates are the decisive factor. Currently, the Fed would need to raise interest rates to at least 9% to enable positive real interest rates and combat inflation, as Volcker did. You can imagine the impact of 9% interest rates on the real estate market or the refinancing of globally indebted countries. The likelihood is high that the Fed will eventually back down and keep interest rates well below the inflation rate.