Investment Strategy and Objectives:

The Commodity Capital Global Mining Fund provides a thorough diversification strategy within the commodity sector, enabling investors to effectively spread associated risks. This diversification is accomplished through a well-balanced allocation across various precious metals, mining life cycles, and international markets. Our investments are exclusively directed towards stable countries with transparent and established legal systems. We primarily focus on stocks of junior companies, while exploration and major companies play complementary roles in our diversified investment portfolio.

Investment team:

The fund's investments are overseen by Tobias Tretter, responsible for providing investment advice, and Abid Mukhtar, responsible for portfolio management.

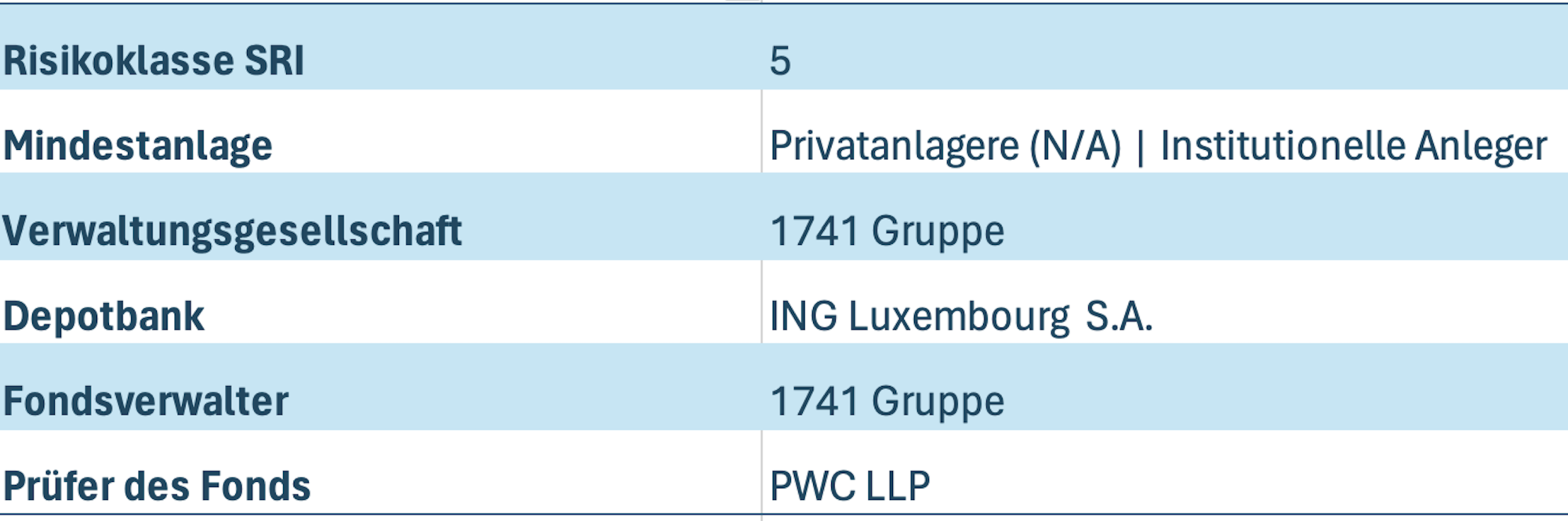

KEY FACTS

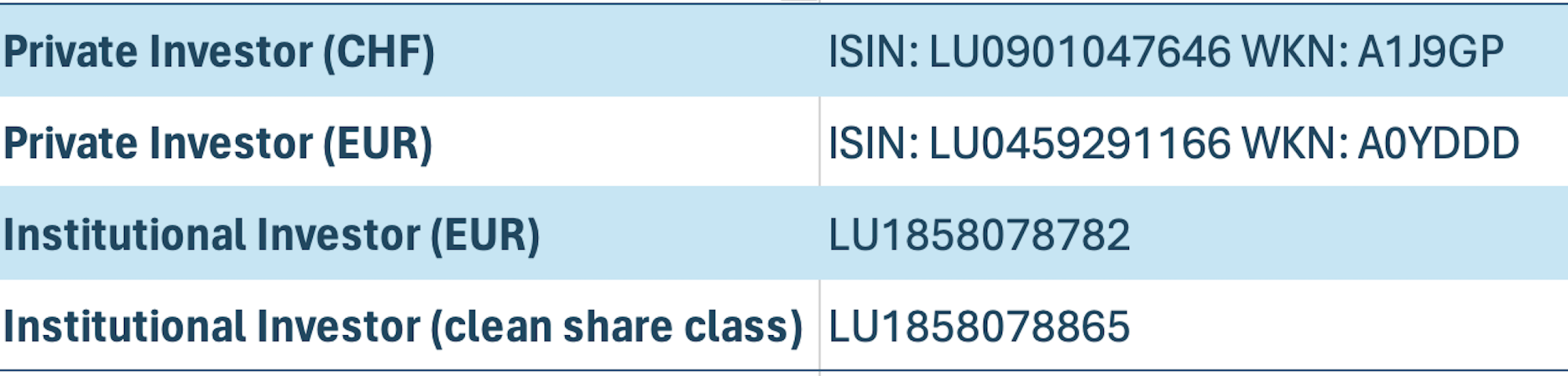

SECURITIES IDENTIFICATION NUMBER

LU0459291166 Commodity Capital - Global Mining Fund - P

DAILY FACTSHEET

Factsheet tagesaktuell CHF (available in German)

Factsheet tagesaktuell Insti-Tranche (available in German)

MONTHLY FACTSHEET

Ultimo Factsheet CHF (available in German)

Ultimo Factsheet Insti-Tranche (available in German)

Raw materials allocation

Investment allocation

Geographic allocation

MANAGEMENT COMMENTARY

OTHER FUND DETAILS

ATTACHMENTS

Investment Accessibility?

The fund has been listed on the Hamburg Stock Exchange and is available for public sale in Luxembourg, Germany, and Austria. Investors can conveniently purchase it through various banks and online platforms, ensuring easy access to the fund. Notably, the fund is in compliance with UCITS IV, adhering to the regulatory framework for the cross-border distribution of investment funds in Europe.

Commitment to Ethical Principles:

We are dedicated to upholding international fundamental values concerning human rights, labor laws, and environmental protection. Child labor and environmental pollution are amongst the factors that are absolute exclusion criteria for our investment decisions.

For a comprehensive insight into our fund, we encourage you to explore the attached documents. You can also access further information on Bloomberg by using our code: CCGLMCH LX. Asset managers seeking MiFID 2 compliant share classes without trailer fees are kindly requested to contact us. You can reach out to us via email at info@commodity-capital.com or by phone at +41 78 661 3991. We are eager to assist you with your specific needs.