ABOUT

Investment Strategy and Objectives:

The Structured Solutions Next Generation Resources Fund is an actively managed investment fund that focuses on resource companies at the forefront of "next generation" resources, including lithium, cobalt, graphite, and other essential materials vital for advancing key technologies. While the fund will continue to leverage opportunities in the lithium sector to secure above-average returns, it also embraces the inclusion of other resources crucial to emerging technologies. Additionally, the fund is well-positioned to capitalize on opportunities within traditional base and precious metals companies, as these resources remain essential for the development of new technologies

Investment Accessibility?

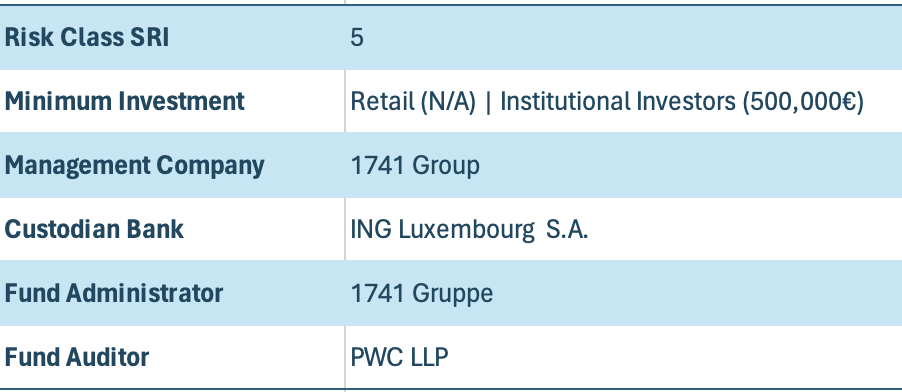

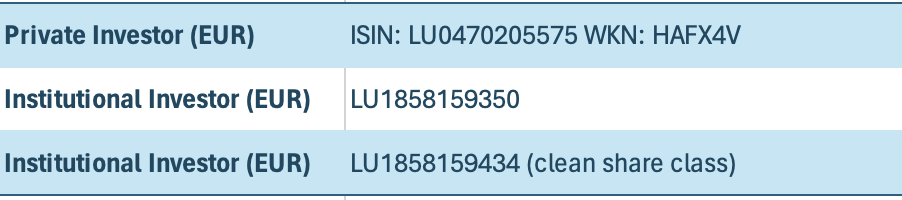

The fund has been listed on the Hamburg Stock Exchange and is available for public sale in Luxembourg, Germany, and Austria. Investors can conveniently purchase it through various banks and online platforms, ensuring easy access to the fund. Notably, the fund is in compliance with UCITS IV, adhering to the regulatory framework for the cross-border distribution of investment funds in Europe.

Investment team:

The fund's investments are overseen by Tobias Tretter, responsible for providing investment advice, and Abid Mukhtar, responsible for portfolio management.